FinSecure Bank’s AI-Powered Fraud Detection

November 28, 2024, 3 min read

In today’s fast-paced digital world, financial fraud is an ever-present threat. However, FinSecure Bank, a leader in financial innovation, is rewriting the fraud detection rules. With its cutting-edge AI-powered fraud detection system, the bank has achieved an extraordinary 60% reduction in fraud while enhancing customer experience by minimizing false alarms. Learn more about FinSecure Bank’s AI-Powered Fraud Detection now.

This milestone underscores FinSecure’s commitment to safeguarding its customers and redefining secure banking in the 21st century.

Why Traditional Fraud Detection Falls Short

As financial systems grow more intricate, so do fraudsters’ methods. Traditional fraud detection tools, which rely on static rules and historical financial data, struggle to keep up with the ever-changing landscape of fraud. These outdated systems are often reactive, labor-intensive, and prone to generating false alarms, frustrating both customers and staff.

FinSecure Bank recognized this gap and took action, embracing artificial intelligence to create a more adaptive, efficient, and customer-friendly fraud detection solution.

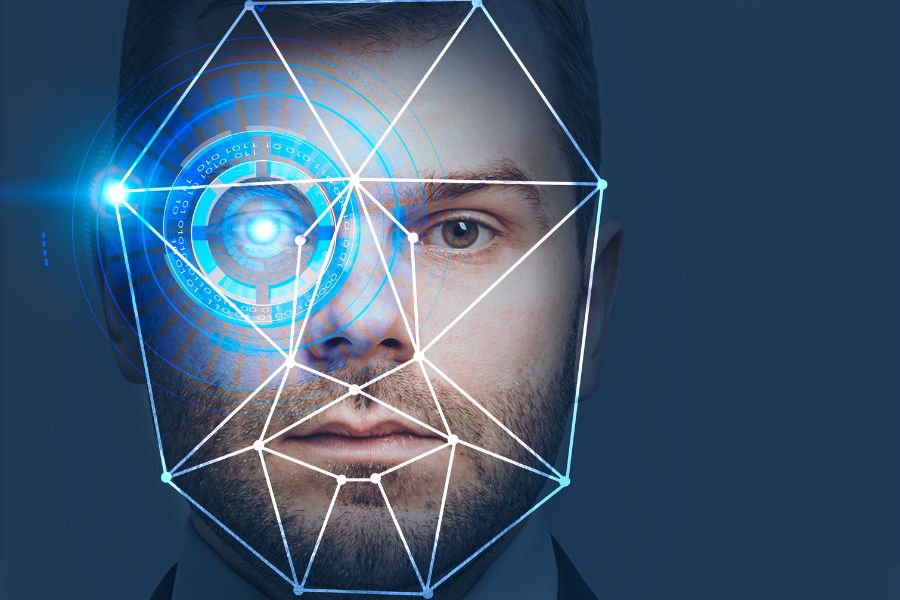

How the AI-Powered System Works

At the heart of FinSecure’s transformation lies a sophisticated machine-learning engine. This AI system analyzes vast transaction data in real time, identifying patterns and anomalies that may signal fraudulent behavior. Its ability to continuously learn makes it exceptional—adapting to new fraudster techniques and becoming more precise over time.

Here’s how it works:

- Customer Profiling: The system builds a unique behavioral profile for each customer based on their transaction history.

- Real-Time Monitoring: Every new transaction is evaluated against the customer’s profile and patterns of known fraudulent activity.

- Swift Action: Suspicious transactions are flagged for further review, allowing the bank to respond instantly and minimize potential damage.

This real-time vigilance doesn’t just detect fraud—it actively prevents it, creating a safer financial environment for everyone involved.

Game-Changing Results

Since introducing the AI system, FinSecure Bank has experienced a remarkable 60% reduction in fraudulent activity. This accomplishment isn’t just a win for the bank; it’s a victory for customers, who are now less likely to suffer the financial and emotional toll of fraud.

One of the standout features of the AI system is its ability to strike the perfect balance between sensitivity and specificity:

- Fewer False Positives: Legitimate transactions are rarely flagged as fraudulent, reducing customer inconvenience.

- Enhanced Accuracy: Real threats are detected with precision, ensuring fraudsters are stopped in their tracks.

This delicate balance has transformed the customer experience, with smoother transactions and heightened trust in the bank’s security measures.

Building Customer Confidence

FinSecure Bank has gone beyond technology by fostering transparency and trust with its customers. Through newsletters, social media, and in-app notifications, the bank has explained how its AI system works and the benefits it delivers.

This proactive communication has empowered customers, reinforcing their confidence in the bank’s commitment to protecting their assets. The results are clear: smoother transactions, fewer interruptions, and a more satisfying banking experience.

Leading the Charge in Financial Security

FinSecure Bank’s success is more than just a technological achievement; it’s a blueprint for the future of financial security. By leveraging AI to stay one step ahead of fraudsters, the bank is setting a new standard for what’s possible in digital banking.

And this is only the beginning. FinSecure is committed to continuous improvement, regularly updating its systems and exploring emerging technologies to anticipate and counter new threats.

A Bright Future for Financial Innovation

FinSecure Bank stands out as a beacon of progress as the financial world battles rising fraud risks. Its AI-driven fraud detection system protects customer assets and strengthens relationships through trust and reliability.

This success story sends a powerful message: with the right technology and customer-first mindset, financial institutions can create a future where fraud takes a backseat and secure, seamless banking becomes the norm.

FinSecure Bank isn’t just fighting fraud—it’s redefining the banking experience.