Cyber security in the Financial Industry: Protecting Sensitive Financial Data

September 22, 2023, 8 min read

The development of cyberattacks targeting the financial industry has led to the enactment of several mandatory cybersecurity legislations. Regulatory compliance is a highly effective means of ensuring financial services maintain their security posture, even though security teams might perceive it as an unnecessary burden.

Legislation must be flexible to keep up with the ever-changing nature of cyber security threats. As a result, the financial industry must vigilantly monitor the development of new information security standards and the evolution of existing ones.

The absence of a dependable reference for all the legislation affecting financial organizations unnecessarily increases the stress of such a burden.

To address this unspoken annoyance, we’ve developed a list of all the major cyber security rules affecting the financial services sector. There is a summary of the consequences of non-compliance and a list of compliance resources for each item.

Read on to find out what financial regulations pertain to you and how to improve cyber security in financial services.

The Importance of Cyber Security in the Financial Industry

Cyber security is the collection of technology, procedures, and methods to prevent harm, data loss, illegal access, malware, viruses, hacking, and other forms of cybercrime.

The basic objective of cyber security in the financial sector is customer asset protection. More and more consumers are ditching cash in favor of digital payments. Digital payment systems like debit and credit cards are widely used in everyday commerce, necessitating the highest level of security to prevent fraud.

Cybersecurity has been given a high priority in the financial sector. Credibility and trust are the bedrock of the banking industry hence their cultivation is paramount. The following five factors demonstrate the importance of cyber security in the financial sector:

No one appears to be carrying any cash; instead, they are all using various forms of electronic payment, such as debit and credit cards. It is crucial in this scenario to confirm that adequate cyber security protections are in place to defend your privacy and data.

It may be difficult to trust financial institutions after data breaches. That’s a major problem for financial institutions. They may lose customers if their data is compromised due to inadequate security measures.

Time and money are usually lost when a bank’s data is stolen or hacked. The process of getting over the same can be unpleasant and lengthy. That would require canceling cards, checking statements, and being vigilant for problems.

Your personal information may be seriously compromised if it fell into the wrong hands. Even if cards are canceled and fraud is quickly addressed, your sensitive data could be exposed, exposing a wealth of information that could be used against you.

Banks need to use greater caution than other types of businesses. It is the cost for banks to keep your valuable personal information. The bank’s data is at risk of being stolen if it is not protected against cybercriminals.

This is the answer to the question of why cyber security is important in the financial industry.

Cyber Threats and Risks in the Financial Industry

Each industry has its own unique set of challenges that must be overcome. The best way to strengthen your cyber security is to know the most pressing dangers facing your company and the industry. Do you have any idea of the problems that the financial services sector is facing right now?

There is a lot for financial institutions to fret over, from shifts in the market to attacks on their credibility. But, as compared to cyber security worries, these are minor concerns at best. Few people are shocked when a data breach at a bank or other financial institution reaches the headlines these days. That’s because it seems to be happening so frequently that the initial astonishment has worn off.

IntSights found that last year, 25.7% of all malware assaults were directed at financial institutions, including banks. This was by far the highest compared to the other 27 sectors studied. Unsurprisingly, this industry required rules to prevent cyberattacks, given the frequency with which they occur.

While cyber security is undoubtedly a top priority, what other dangers should you look out for? In this piece, we’ll go over some of the most common cyber threats that banks and other financial institutions face today and some preventative measures you may take.

As a financial institution, your company has a great deal of private information, including that of your customers and employees. Because of this, opportunistic cybercriminals may target you. These hackers have a wide arsenal of cyberattacks and can use them to break into your system. Various forms of cybercrime frequently target the financial services industry.

Web application attacks: Google Apps for Work is one of the most widely used web programs, and many businesses rely on it. Employees may easily share files and work together thanks to these programs. Yet, due to their convenience and reliance on user input, these services are prone to being attacked. Redirects to malicious sites or links that lure people into clicking on them are possible outcomes of these attacks.

“Bots” refer to computer programs that are programmed to carry out specific actions in the virtual world. The usage of bots is commonplace in the finance industry. Companies often use them to enhance customer service. Remember that not all bots have the same intent. Malicious bots serve various purposes, such as email spam and brute-force password attacks.

Malware, known as ransomware, can encrypt your data and even your OS if it manages to infiltrate your system (OS). You will be unable to access any of your important files or use your device. The term “ransomware” refers to the attacker demanding payment before releasing the encrypted data. This is now commonly reported as a method of attack against banks and other financial institutions.

Similar in frequency to ransomware attacks is phishing. These assaults utilize social engineering to deceive your staff into taking action, allowing malware deployment on a network.

Best Practices for Cyber Security in the Financial Industry

Best practices in cyber security are essential for keeping your data safe from attacks like this. Several considerations are listed below.

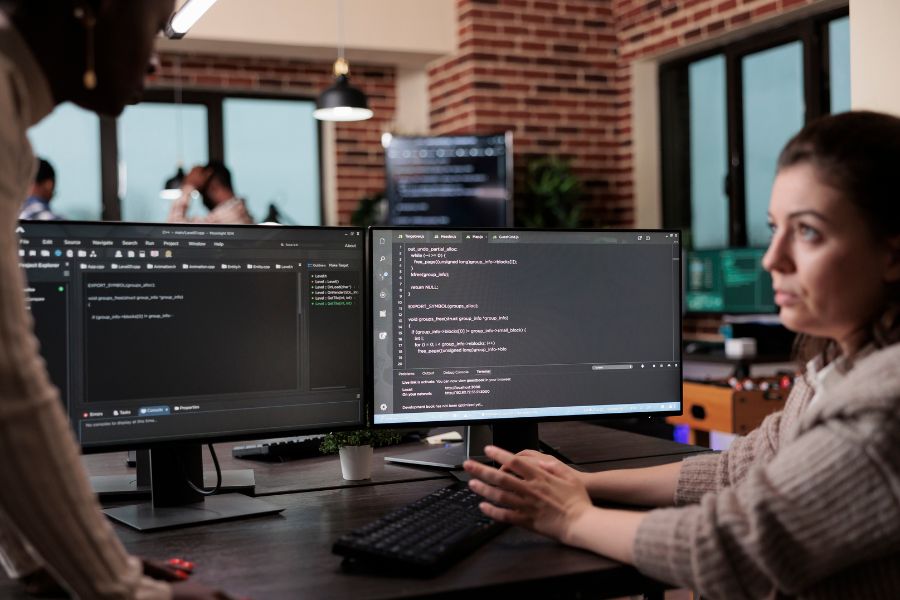

Proper cyber security hygiene begins with giving your staff the tools to recognize intrusion attempts and avoid opening new holes.

Conduct a cyber security Risk Assessment: A risk assessment evaluates potential threats to a company’s day-to-day operations and ranks them in order of severity. It’s an essential component of any comprehensive cybersecurity plan.

It’s time for an update: Don’t underestimate the value of keeping your security software current. Developers regularly update antivirus and anti-malware programs to combat the latest cyber threats.

Technologies and Tools for Enhancing Cyber Security in the Financial Industry

Integration of security measures: Financial institutions must employ cutting-edge security measures due to stringent government oversight. It might be challenging to keep up with the constant advancements in cybersecurity. That’s why it’s a good idea to adopt an integrated and often automated security setup, in which each part talks to and cooperates with the others.

Data analytics is a key component in enhancing cyber resilience, along with machine learning. Thanks to a new generation of security analytics, it’s now possible to evaluate and store all this security data in real-time.

Realize how crucial cyber security is: many people make the mistake of viewing it only as an extra expense. Instead, view it as an asset with alternative uses. Assess bank security risks and their potential impact on the entire financial institution. The value of safety becomes evident only after an incident occurs.

Banks and other financial organizations should implement cutting-edge endpoint security measures to prevent breaches like this. They need to use cutting-edge security measures to do away with the threats altogether.

Ensure the security of your data. Information can reside in diverse locations, including the cloud, in today’s environment. Therefore, use cybersecurity to safeguard all systems storing such private data.

Raising client awareness is essential in the fight against cybercrime. The service provider is responsible for making the consumer aware that they should not share their credentials with anyone. Customers are obligated to notify cyber security of any incidents. They must move quickly if anything unusual happens when doing routine transactions or with the bank account.

Using anti-malware and anti-virus software: A firewall will increase security but not prevent attacks. Protect yourself more effectively by always using the most recent antivirus and anti-malware software versions. Keeping your software up-to-date can prevent intrusions.

Future Trends in Cyber Security for the Financial Industry

Let’s dive into the cyber security trends in financial services.

A zero-trust paradigm, gaining traction as an alternative to password protection, is one possible line of defense. According to the most recent Verizon Data Breach Report, poor or repeated passwords account for 80% of data breaches.

In a zero-trust paradigm, users must consistently verify their identity to access sensitive data. Though effective, the ‘Castle and Moat’ strategy risks system exposure if the firewall is breached. Zero trust hinders lateral network spread by creating obstacles against malicious actors. Even if you manage to break through one barrier, there will always be another one in your way. The organization will have more time to prepare for, identify, and counter an assault.

Teramind found that in 2021, businesses that had fully implemented zero-trust architecture reduced the costs of data breaches by 43 percent. It’s also the best and quickest method for overseeing the safety of remote employees. Multi-factor authentication, continuous validation, intelligent monitoring (AI), least privilege, and micro-segmentation are all examples of zero-trust practices.

Artificial Intelligence and Cybersecurity

AI offers multiple methods for enhancing data security beyond smart monitoring. Properly deployed, well-trained AI acts like a vigilant guard dog, detecting intruders and triggering alarms.

Programmed to handle cognitive tasks, AI monitors bank systems for anomalies such as employees accessing restricted files or customers making unusual credit card purchases.

Anything out of the ordinary will trigger an alert and prompt further investigation.

While humans can handle these tasks, performing them globally around the clock at scale is unlikely. Artificial intelligence can operate indefinitely, promptly reporting detected questionable activity. Recent research found that businesses utilizing AI and security automation were 27% quicker to detect and contain data breaches.

Conclusion

Fintech and traditional financial institutions (FIs) are subject to similar rules and regulations. Since they deal with sensitive client information, companies are subject to several regulations. Client information is required to be kept secure by all financial institutions. Because of this, industries like these are particularly vulnerable to data breaches. Mishandling sensitive customer information can result in fines and the loss of a company’s business license, in addition to irreparable damage to the company’s reputation.