The Role of AI in Cyber Security for InsurTech Companies

June 23, 2023, 6 min read

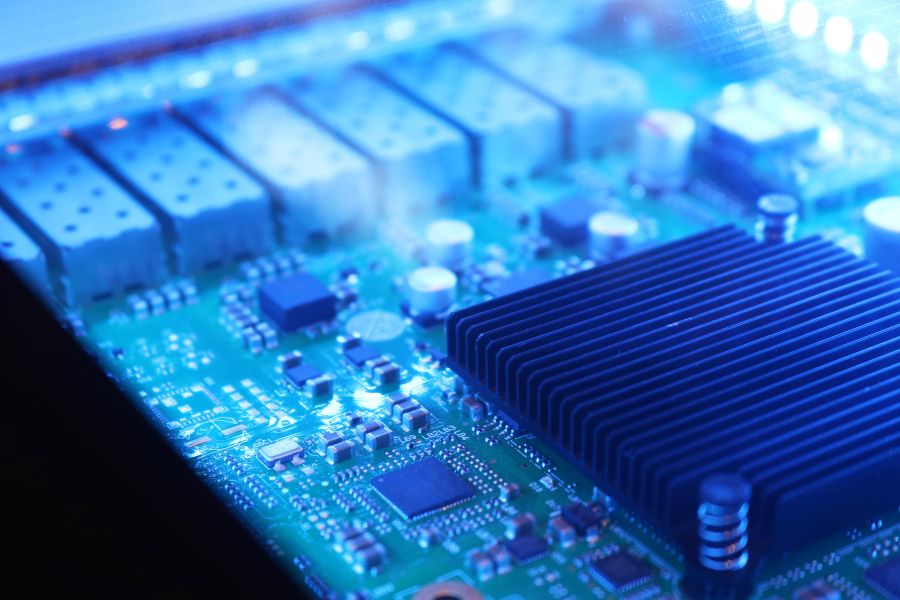

Cyber security is critical for companies across sectors, including those integrating technology with traditional insurance services. Stringent measures are essential for organizations handling vast volumes of sensitive client data. Artificial intelligence (AI) has emerged as a powerful tool against online threats. This article explores AI’s role in cyber security, focusing on InsurTech companies, its benefits, and the challenges they face in this dynamic landscape.

In today’s interconnected world, maintaining robust cyber security is crucial due to technology’s pervasiveness in our lives. However, the digital age’s business growth has also given rise to intricate security challenges. InsurTech companies, combining traditional insurance services with technology-driven solutions, are particularly vulnerable due to their handling of sensitive customer data.

Operating in the insurtech space involves managing vast amounts of sensitive personal and financial data, including client profiles, policy details, claims history, and payment information. This makes them attractive targets for cybercriminals. Breaches in their cyber security defenses can lead to significant financial losses, reputational damage, and potential legal consequences.

InsurTech firms are rapidly turning to Artificial Intelligence (AI) as a potent tool to improve their cyber security measures. This is because these organizations are aware of the crucial significance of securing client data. Artificial intelligence has been useful in a variety of fields, but the field of cyber security is one in which it has emerged as a game-changer. InsurTech companies can stay one step ahead of cyber threats and successfully minimize potential risks when they leverage the powers of artificial intelligence (AI).

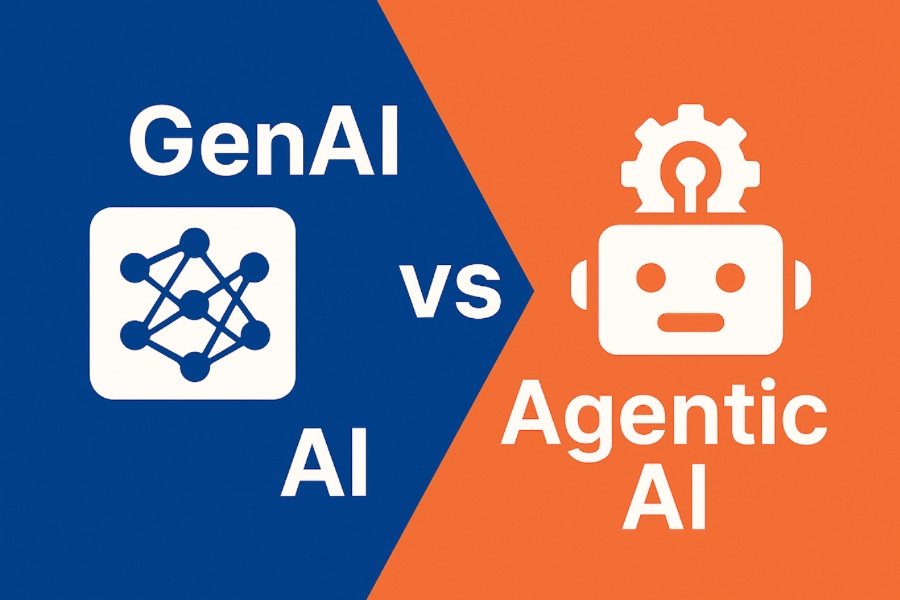

Understanding the Role of Artificial Intelligence (AI) in Cyber Security

There are many facets to the function that AI plays in the cyber security of InsurTech organizations. Enhancing capabilities in terms of identifying potential dangers is one of its key roles. The identification of known dangers by traditional cyber security systems frequently involves the use of predetermined criteria and digital signatures. The dynamic nature of cyberattacks poses challenges for these systems to keep pace. However, AI excels in analyzing large data volumes, learning patterns, and detecting anomalies or deviations from normal behavior that signal potential cyber threats. AI-powered systems can deliver real-time alerts and warnings because they continuously monitor network traffic, user activity, and system logs. This makes it possible to take prompt action to mitigate any dangers.

Artificial intelligence (AI) recreates human intellect in computers to perform tasks that typically rely on human cognitive abilities. In cyber security, AI algorithms enable real-time analysis, detection, and response to threats. AI learns from large data volumes and adapts responses accordingly, surpassing traditional rule-based techniques. This makes AI a valuable asset in combating ever-evolving cyber threats.

Overview of InsurTech and Cyber Security Challenges

InsurTech companies have disrupted the traditional insurance sector by utilizing technology to improve operational efficiencies, the quality of the customer experience, and the range of products on offer. However, as a result of this digital change, they are also more vulnerable to emerging cyber security threats. InsurTech companies handle a wide variety of sensitive data, including customers’ personal information, financial records, and insurance policies, amongst other things. Unauthorized loss, theft, or access to this data can cause severe harm to both the company’s finances and reputation.

https://globalcybersecuritynetwork.com/blog/cyber-security-of-genomic-data-2023/

InsurTech companies face several cyber security challenges, such as:

Advanced Persistent Threats (APTs)

APTs are sophisticated cyber attacks that target organizations over an extended period. InsurTech companies, with their valuable data assets, are attractive targets for APTs seeking to gain unauthorized access and exploit vulnerabilities.

Phishing and Social Engineering

InsurTech companies must be vigilant against phishing attacks, where attackers impersonate legitimate entities to trick employees into divulging sensitive information or downloading malicious files. Attackers frequently employ social engineering techniques to manipulate individuals into compromising security.

Insider Threats

Insiders, including employees, contractors, or business partners, can pose significant risks to data security. These individuals may intentionally or unintentionally misuse their access privileges, leading to data breaches or other security incidents.

Benefits of AI in Cyber Security for InsurTech

Many advantages may be realized when utilizing artificial intelligence to strengthen the cyber security defenses of InsurTech organizations. Let’s have a look at some of the most important benefits:

- AI-powered systems analyze vast data volumes in real time, enabling advanced threat detection and early identification of cyber attacks. Machine learning algorithms can recognize trends and anomalies, enhancing the company’s proactive response to potential hostile activities.

Real-time Incident Response

- AI systems automate incident response, enabling quick and accurate actions against cyber threats. InsurTech firms reduce potential damage by swiftly detecting and responding to threats, leveraging AI’s rapid information processing capabilities.

- AI systems may learn standard user behavior patterns and detect any abnormalities suggesting suspicious activities. Behavioral analytics is the branch of analytics that enables the identification of insider threats or compromised accounts, facilitating prompt action to prevent data breaches.

Enhanced Data Protection

- InsurTech companies handle sensitive client data, including personally identifiable information (PII). Combined with encryption and data masking, AI enhances data protection measures and safeguards consumer information against unauthorized access.

Fraud Detection and Prevention

- AI may be used to construct fraud detection models that analyze massive datasets to identify fraudulent actions. These models can then be used to prevent fraud. AI systems can detect anomalies and highlight potentially fraudulent behavior by monitoring transactions, claims, and policy information. This can prompt additional inquiry or action, depending on the severity of the anomaly. This assists insurance technology firms in avoiding financial losses and preserving the integrity of their business processes.

Streamlined Compliance

- Complying with regulatory obligations like GDPR or HIPAA is crucial for data security in InsurTech. AI can automate compliance operations, monitor data handling practices, identify potential infractions, and suggest corrective actions to minimize non-compliance risks and penalties.

- Intelligent threat hunting involves actively searching an organization’s systems for vulnerabilities and hidden dangers using AI-powered software. AI can discover possible weak points in a system that cyberattackers could exploit by analyzing data logs, network traffic, and user behavior. [Cyberattackers] may exploit these potential weak points. This preventative strategy enables insurance technology businesses to remain one step ahead of any potential dangers.

Analytics Predictive

- AI systems can analyze past data and find patterns and trends that may suggest future cyber dangers. This type of analysis is known as predictive analytics. By utilizing predictive analytics, InsurTech companies can anticipate attack vectors and proactively implement preventive measures to mitigate risks.

Enhanced User Authentication

- Artificial intelligence can improve user authentication by employing biometric data, behavioral analysis, and anomaly detection. This enhances access restrictions and lowers the likelihood that sensitive data and systems may be accessed without authorization.

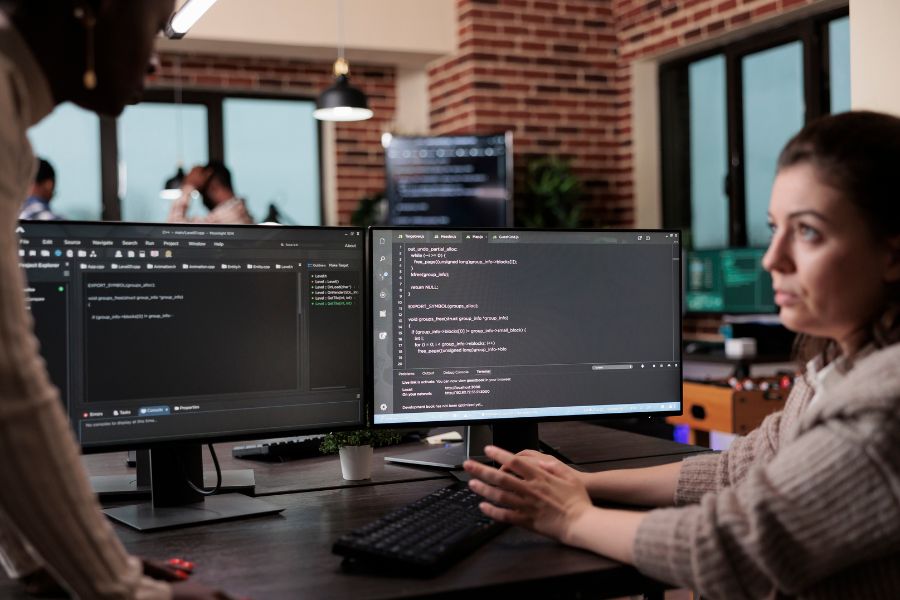

Education and Training in Cyber Security

- Simulated real-world attack scenarios enable staff to practice recognizing and responding to cyber attacks in a safe environment. This fosters a cyber security culture within InsurTech firms, enhancing awareness.

Conclusion

In a world that is becoming increasingly digitized, insurance technology firms have a growing responsibility to prioritize cyber security to safeguard their precious assets and preserve the trust of their clients. Moreover, in this rapidly changing environment, organizations can utilize artificial intelligence as a powerful solution to enhance their cyber security defenses.

InsurTech organizations can significantly enhance their cyber security by leveraging artificial intelligence (AI) for various purposes, including threat detection, incident response, data protection, and fraud prevention. However, it’s important to remember that AI is not infallible. Therefore, combining it with other security measures and human skills becomes vital. To maintain a high level of cyber security within the InsurTech industry, continuous monitoring, regular updates to AI algorithms, and staying informed about emerging cyber threats are essential. The significance of artificial intelligence (AI) in cyber security will only grow as technology continues to advance. This will enable insurance companies to stay ahead of the constantly shifting threat landscape and safeguard their operations and client data.