What Are The Warning Signs Of Pig Butchering Scams?

March 21, 2025, 14 min read

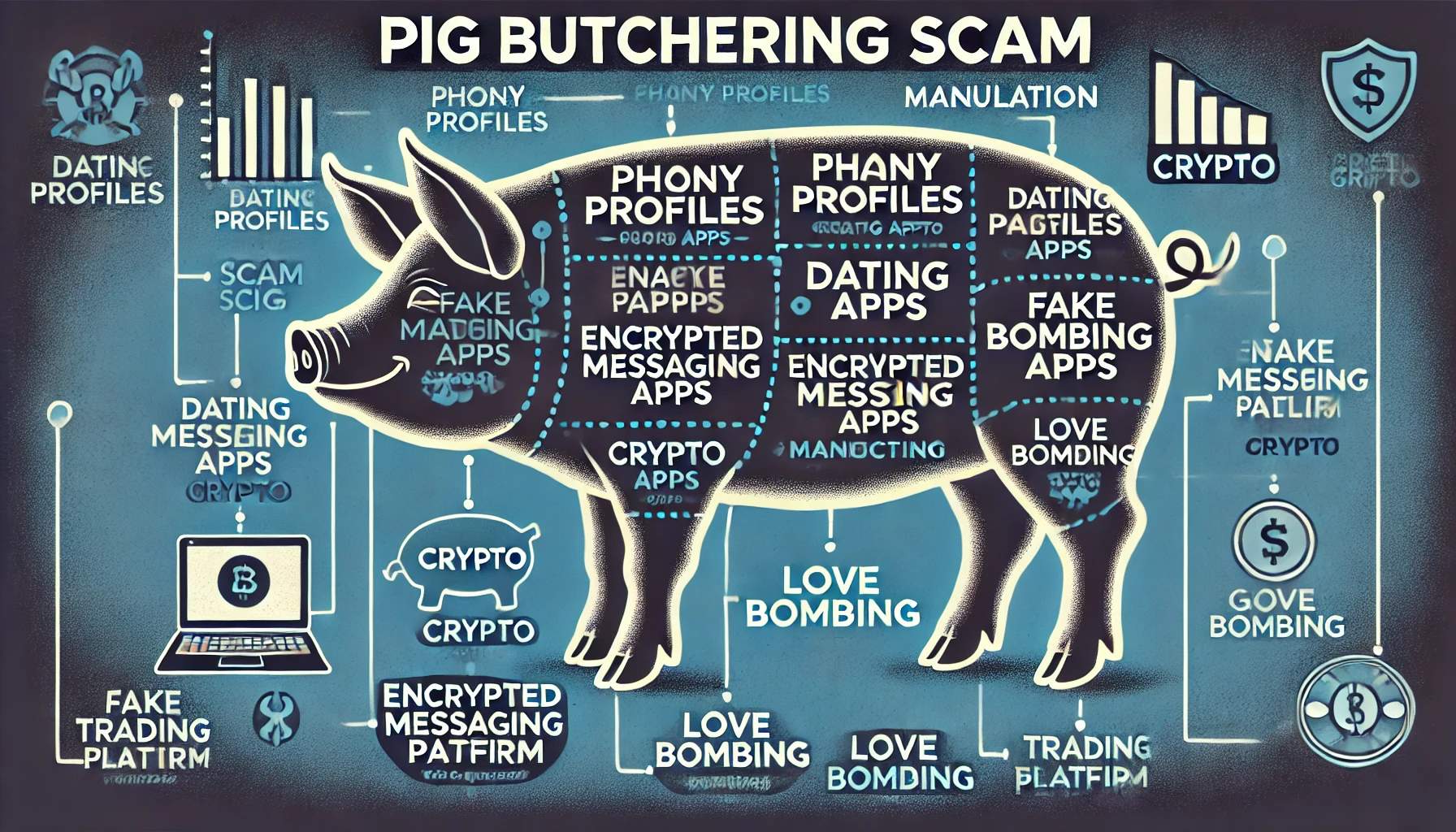

In recent years, a sophisticated form of financial fraud known as Pig Butchering scams has emerged as a significant threat to online users. These elaborate schemes, which combine elements of romance scams and crypto investment scams in 2026, have become increasingly prevalent across social media platforms, dating apps, and messaging services. It could be hard to find pig butchering scam warning signs. The scammers behind these operations employ highly sophisticated social engineering tactics, often working in organized criminal networks with detailed scripts and methodologies. Their targets span all demographics, though they frequently focus on professionals with disposable income and individuals new to cryptocurrency investments. The scams have evolved to incorporate artificial intelligence and advanced technology, making them increasingly difficult to detect. What makes these schemes particularly dangerous is their ability to bypass traditional security measures through their heavy reliance on psychological manipulation and trust-building. The financial losses from these scams have reached unprecedented levels, with some victims losing their life savings and retirement funds and even borrowing money to invest in these fraudulent schemes. Unlike traditional scams that might be executed quickly, these operations often unfold over months, allowing scammers to extract maximum value from their victims while making the deception more convincing through sustained, seemingly genuine relationships. The rise of digital payment systems and cryptocurrency has made it easier for these criminals to operate across international borders, complicating law enforcement efforts and making fund recovery nearly impossible.

Understanding the Evolution of Pig Butchering Scams

These scams earned their name from the tactic of “fattening up” victims before metaphorically slaughtering them financially. Scammers invest considerable time building trust and rapport before introducing seemingly lucrative investment opportunities, making online fraud prevention increasingly challenging. The methodology has evolved significantly since its emergence in Southeast Asia, becoming more sophisticated by integrating artificial intelligence and advanced social engineering techniques. Scammers now operate in organized criminal networks, often utilizing forced labor in scam compounds to execute these elaborate schemes at scale.

The evolution of these scams has been particularly notable in their adaptation to crypto investment scams 2026, incorporating complex technological tools and psychological manipulation strategies. Modern pig butchering operations utilize advanced CRM systems to track victim interactions, employ machine learning for personalized approach strategies, and maintain extensive databases of successful scripts and techniques. They have moved beyond simple fraud to create elaborate fake personas with detailed backstories, professional-looking social media profiles, and convincing financial expertise credentials.

The sophistication of these operations now includes multiple layers of deception, including fake news articles, fabricated investment success stories, and counterfeit regulatory certificates. Scammers have also adapted their techniques to bypass traditional security measures, using legitimate-looking cryptocurrency wallets and creating convincing clone websites of real trading platforms. This evolution has made Pig Butchering scam warning signs increasingly challenging to detect as criminals continually refine their methods to appear more legitimate and professional.

Recent developments show these scams incorporating elements of legitimate financial services, such as professional-looking portfolio management interfaces and detailed market analysis reports. The criminals behind these operations have also begun targeting specific demographic groups with tailored approaches, making their schemes more effective and more complicated to identify. They frequently update their tactics based on current events and market trends, ensuring their pitches remain relevant and convincing to potential victims.

Initial Contact and Trust Building

The first warning sign typically involves unsolicited messages from attractive profiles on social media or dating platforms. These scammers often claim to be successful investors or entrepreneurs, carefully crafting their personas to appear legitimate and trustworthy. They frequently initiate conversations with seemingly innocent topics, such as shared interests or professional backgrounds, making the interaction feel natural and coincidental.

These manipulators excel at mirroring their victims’ interests and values, creating an illusion of genuine connection. They often present themselves as successful expatriates working in finance or technology sectors, with carefully curated photos showcasing a luxurious lifestyle. Their profiles typically feature professional headshots, travel pictures, and displays of wealth, all designed to enhance their credibility.

The trust-building phase involves calculated steps where scammers demonstrate extensive investment knowledge, particularly in cryptocurrency markets. They share supposedly personal experiences of financial success, often including screenshots of profitable trades or bank balances. This approach helps establish their expertise while making victims more receptive to future investment suggestions.

A distinctive characteristic of these initial interactions is the scammer’s ability to maintain consistent communication while avoiding any real-time verification of their identity. They craft elaborate backstories explaining their presence in the victim’s social media sphere, often claiming to have mistakenly contacted them but feeling an immediate connection. Their responses are well-thought-out, grammatically correct, and professionally toned, though they may occasionally include strategic spelling errors to appear more authentic.

During this phase, scammers also employ sophisticated psychological tactics, such as love bombing and artificial scarcity, to accelerate trust-building. They might send thoughtful messages throughout the day, remember small details from previous conversations, and express genuine-seeming interest in the victim’s life and well-being. This constant attention and apparent emotional investment makes victims more likely to lower their guard and accept subsequent financial proposals.

Red Flags in Communication Patterns

When engaging with potential scammers, distinct patterns emerge in their communication style that serve as crucial warning signs. These individuals often employ sophisticated social engineering techniques, carefully crafted to manipulate victims while maintaining control of the narrative. They frequently use predetermined scripts, resulting in conversations that feel natural but follow specific patterns designed to build false trust.

The communication typically shows several distinctive characteristics that should raise immediate concern. Scammers often mirror their victims’ interests and values, creating an illusion of deep connection. They may share carefully edited photos that appear genuine but are stolen from legitimate profiles. Their messages frequently arrive at consistent times, suggesting automated responses or coordinated efforts from scam centers.

- Rapid escalation of personal conversations

- Consistent messaging but avoiding video calls

- Stories about their successful trading experiences

- Reference to specific investment platforms or opportunities

Beyond these initial signs, scammers often display unusual language patterns, mixing perfect business English with occasional grammatical errors. They tend to overshare personal information early in conversations while simultaneously being vague about specific details of their life or work. Their responses to direct questions about their background or location often seem rehearsed or evasive, and they may quickly redirect conversations back to topics they control.

Most notably, these fraudsters demonstrate an uncanny ability to maintain constant communication, often messaging at odd hours or responding with unnatural speed. They frequently use emotional manipulation, alternating between showing concern for their victim’s financial future and creating urgency around investment decisions. When faced with skepticism or questioning, they typically respond with practiced rebuttals and may attempt to guilt-trip their targets for showing doubt.

The Investment Pitch

A critical component of fake trading platform scams is the eventual transition to discussing investments. Scammers often introduce seemingly exclusive investment opportunities, promising unrealistic returns through cryptocurrency trading or forex markets. These fraudsters typically begin by sharing their “success stories” and showing fabricated screenshots of their trading profits to entice victims. They carefully orchestrate their approach, starting with small investment suggestions to test the victim’s willingness to participate.

The investment proposals usually involve sophisticated-sounding trading strategies and complex financial terminology to overwhelm victims with information. Scammers might reference actual market trends and legitimate financial news to add credibility to their schemes. They often claim insider knowledge or specialized trading algorithms that can generate exceptional returns, far above what traditional investments typically offer.

During the pitch phase, fraudsters frequently emphasize the potential for passive income and financial freedom, targeting victims’ desires for financial security. They might offer to “mentor” their victims in trading, positioning themselves as experienced investors willing to share their expertise. Some scammers even create elaborate backstories about their connections to prestigious financial institutions or successful tech companies to enhance their credibility.

The investment opportunities presented are often disguised as legitimate cryptocurrency projects or forex trading programs, complete with professional-looking presentations and whitepapers. Scammers may reference well-known cryptocurrencies while promoting their fraudulent investment schemes, attempting to capitalize on the legitimacy of established digital assets. They might also claim special access to pre-sale tokens or exclusive trading pools, creating a false sense of privilege and opportunity for their targets.

These fraudsters often incorporate current market trends and economic events into their narratives to make their pitch more convincing. They might discuss recent cryptocurrency market movements or global financial news to demonstrate their supposed market knowledge and expertise. The investment pitch typically includes detailed explanations of complex trading strategies, which are usually fabricated or grossly oversimplified to appear accessible to inexperienced investors.

Platform Manipulation Tactics

Victims are directed to sophisticated but fraudulent trading platforms that display false profits and manipulated trading data. These platforms are designed to convince victims that their investments generate substantial returns. The interfaces often mimic legitimate trading platforms, complete with professional-looking charts, graphs, and entirely fabricated real-time market data feeds. Scammers employ advanced technological deception, creating elaborate dashboards that show artificial trading activities and inflated account balances.

These manipulated platforms frequently include features like automated trading bots that supposedly generate consistent profits, fake transaction histories, and falsified performance metrics. The scammers may even provide victims with demo accounts initially, showing how easy it is to make money before transitioning them to “live” trading accounts. The platforms often display seemingly legitimate security certificates and regulatory compliance badges, which are typically forged or stolen from legitimate websites.

To make the deception more convincing, these fake trading platform scams incorporate sophisticated elements such as realistic market volatility, detailed trade execution reports, and professional-looking portfolio analysis tools. The platforms may also feature counterfeit user reviews and testimonials, often displaying profiles of supposed successful traders who have achieved significant returns through the platform. Some advanced versions even include fake customer support channels staffed by members of the scam operation, who provide seemingly professional assistance while furthering the deception.

The technical sophistication of these platforms has evolved significantly to counter online fraud prevention measures, making them increasingly difficult to distinguish from legitimate trading services. They often include features like two-factor authentication and encrypted communications to create an illusion of security. The platforms might also display real-time cryptocurrency prices pulled from legitimate exchanges, blending actual market data with manipulated account information to maintain credibility.

Pressure Tactics and Urgency

Scammers employ sophisticated pressure tactics designed to create a false sense of urgency around investment decisions. These manipulative strategies often involve fabricated market trends, artificial deadlines, and carefully crafted narratives about other investors’ supposed successes. The perpetrators of crypto investment scams 2026 frequently emphasize the fear of missing out (FOMO) to push victims into making hasty decisions.

- Time-sensitive investment opportunities

- Claims of limited availability or exclusive access

- Emotional manipulation to encourage more significant investments

- Frequent updates about “profitable” trades

These urgency tactics are typically accompanied by elaborate stories about market conditions or exclusive deals “only available for a limited time.” Scammers might send screenshots of other investors’ supposed profits or create fictional scenarios where early investors received exceptional returns. They often use psychological triggers such as artificial scarcity and exclusivity to override their victims’ natural caution.

In many cases of Pig Butchering scam warning signs, victims report receiving multiple messages throughout the day, with scammers creating artificial pressure points through constant communication. They might claim that specific investment opportunities are closing soon or that prices are about to surge, leaving victims little time to conduct proper due diligence. Some scammers even fabricate competition among investors, suggesting that others are waiting to take advantage of the opportunity if the victim doesn’t act quickly.

The pressure often intensifies when victims show hesitation, with scammers employing guilt-inducing tactics or suggesting that doubt shows a lack of financial acumen. They might share falsified news articles, manipulated market analyses, or testimonials from fictitious successful investors to add credibility to their urgent demands. These tactics are designed to bypass rational decision-making processes and exploit emotional vulnerabilities.

Warning Signs During the Investment Phase

Learning to avoid Pig Butchering scams involves recognizing several key indicators during the investment phase. Watch for requests to transfer funds through cryptocurrency, pressure to increase investment amounts, and claims of guaranteed returns. Scammers typically demonstrate consistent patterns during this crucial phase, including showing fabricated trading charts and market analyses that appear professional but are entirely fraudulent. They often create a false sense of success by displaying small initial gains to build confidence in their victims.

During this phase, victims might notice unusual requests for personal information or pressure to download specific apps or software for trading purposes. This is the chance to notice pig butchering scam warning signs. These platforms often mirror legitimate trading interfaces but are entirely controlled by scammers. Another significant warning sign is the emphasis on using specific cryptocurrency exchanges or payment methods that offer limited consumer protection or transaction reversibility.

The investment phase also frequently features staged testimonials or references from supposed successful investors, all fabricated to enhance credibility. Scammers might introduce victims to other “successful investors”—actually accomplices—who share positive experiences and encourage larger investments. They often present complex financial terminology and impressive-looking market analysis to overwhelm victims with information, making it difficult to think critically about investment decisions.

Pay particular attention to how profits are calculated and presented. Legitimate investment platforms provide clear, detailed transaction histories and transparent fee structures. In contrast, fake trading platform scams often show inflated profits without proper documentation or use complicated bonus systems to obscure actual returns. The scammers might also introduce additional investment “tiers” or “VIP levels” that promise better returns but require substantially larger deposits.

Another crucial warning sign is the presence of time-sensitive opportunities or special deals that require immediate action. These artificial deadlines are designed to prevent victims from conducting proper due diligence or consulting with financial advisors. The scammers might claim insider information about market movements or upcoming cryptocurrency developments, using this as leverage to push for quick investment decisions.

During this phase, be particularly wary of platforms that lack basic security features like two-factor authentication or proper know-your-customer (KYC) procedures. Legitimate investment platforms prioritize security and regulatory compliance, while crypto investment scams 2026 often bypass these essential safeguards. Watch for inconsistencies in platform interfaces, grammatical errors in communications, or discrepancies in transaction records that might indicate fraudulent activity.

The Withdrawal Problem

When victims attempt to withdraw their supposed profits, they encounter various obstacles. Before releasing funds, scammers might demand additional fees, taxes, or minimum investment requirements. These withdrawal barriers are carefully designed to extract maximum funds from victims while maintaining the illusion of legitimacy. Scammers often present official-looking documents, fake regulatory requirements, or elaborate explanations about international transfer protocols to justify these additional payments.

The withdrawal process in Pig Butchering scam warning signs typically involves multiple layers of deception. Victims might initially see successful small withdrawals to build confidence, but more prominent withdrawal attempts trigger increasingly complex requirements. These can include fabricated blockchain validation fees, anti-money laundering clearances, or account upgrade requirements. Some victims report being asked to pay conversion fees, platform maintenance charges, or even insurance deposits before accessing their funds.

More sophisticated versions of these crypto investment scams in 2026 might involve elaborate excuses about market volatility, system upgrades, or regulatory compliance issues that temporarily prevent withdrawals. Scammers often create urgent situations where victims must act quickly to “protect” their investments by paying additional fees. They might claim that delayed payment of these fees could result in account freezes or complete loss of funds. Some victims report being shown countdown timers or receiving threats about account termination to pressure them into making these additional payments.

The true nature of these withdrawal obstacles becomes apparent when victims realize that regardless of how many additional payments they make, they never gain access to their funds. Each payment leads to another requirement, creating an endless cycle of financial extraction. Scammers might even pose as regulatory authorities or financial security experts offering to help recover funds for additional fees, extending the scam further.

Digital Security Measures

Implementing robust digital security measures is crucial for protecting yourself against sophisticated investment fraud. When encountering potential crypto investment scams in 2026, it’s essential to employ a comprehensive verification approach. Begin by thoroughly investigating any investment platform through official regulatory databases such as the SEC, FCA, or relevant financial authorities in your jurisdiction.

- Verify platform legitimacy through regulatory databases.

- Use reverse image searches for profile pictures

- Research company registration and licensing

- Monitor for copied-and-pasted communication patterns

- Enable two-factor authentication on all financial accounts

- Install and maintain updated cybersecurity software

- Document all communication and screenshot suspicious interactions

- Cross-reference contact information across multiple platforms

Advanced digital security involves utilizing specialized tools and techniques to verify the authenticity of online interactions. For profile pictures, employ multiple reverse image search engines like Google Images, TinEye, and Yandex to identify stolen photos commonly used in Pig Butchering scam warning signs. Pay particular attention to the digital footprint of any investment platform or individual claiming to offer financial opportunities.

When researching company legitimacy, go beyond surface-level verification. Check business registration dates, cross-reference address information, and investigate employee profiles on professional networking sites. Look for inconsistencies in company documentation and be particularly wary of businesses registered in jurisdictions known for lax financial regulations. For enhanced online fraud prevention, maintain detailed records of all platform interactions, including URLs, communication timestamps, and any unusual patterns in website behavior or trading activities.

Recovery and Reporting Steps

If you’ve encountered these scams, document all communications and transactions. Report incidents to relevant authorities, including cybercrime units, financial regulators, and cryptocurrency exchanges used for transfers. When reporting Pig Butchering scam warning signs, maintain detailed records of all interactions, including screenshots of conversations, transaction receipts, and platform interfaces. Contact your bank or financial institution immediately to flag suspicious transactions and potentially freeze accounts to prevent further losses.

Law enforcement agencies specializing in crypto investment scams 2026 require comprehensive documentation to build cases against scammers. Save all wallet addresses used for transactions, platform URLs, and identifying information about the perpetrators. File reports with multiple agencies, including the FBI’s Internet Crime Complaint Center (IC3), the Federal Trade Commission (FTC), and your local police department’s cybercrime unit.

For online fraud prevention, share your experience with relevant online communities and scam awareness groups to help others identify similar patterns. Many cryptocurrency exchanges have dedicated fraud departments that can trace transactions and potentially flag or freeze stolen funds. Work with recovery specialists who have experience dealing with fake trading platform scams, but be cautious of recovery scammers who might target victims with false promises of retrieving lost funds.

Create a detailed timeline of events, including dates of initial contact, investment suggestions, platform introductions, and withdrawal attempts. This documentation proves invaluable for investigations and helps authorities understand how to avoid Pig Butchering scams. Join support groups for scam victims, as they often provide valuable resources and emotional support during the recovery process. Consider working with cybersecurity experts who can help trace digital footprints and potentially identify the scam network’s broader operation.

Building Digital Resilience

Protecting yourself against future scams requires developing a skeptical mindset toward unsolicited investment advice and understanding that legitimate investments never guarantee returns or require urgent action. Building strong digital resilience involves creating robust personal protocols for online interactions, mainly regarding financial matters. This includes updating knowledge about emerging crypto investment scams in 2026 and regularly educating yourself about new fraudulent tactics.

A crucial aspect of digital resilience is establishing personal boundaries in online relationships and maintaining them strictly, especially when investment discussions arise. This means being prepared to question everything, verify independently, and resist emotional manipulation that might cloud judgment. Creating a habit of thorough research before any financial commitment and understanding that legitimate investment opportunities don’t require immediate action are fundamental aspects of online fraud prevention.

Developing digital resilience also means building a network of trusted financial advisors and maintaining regular contact with legitimate investment professionals who can provide second opinions on investment opportunities. It’s essential to stay connected with reputable financial news sources and official regulatory websites to stay informed about the latest Pig Butchering scam warning signs and emerging fraudulent schemes.

Your digital resilience strategy should include regular security audits of your online presence, maintaining strong and unique passwords across platforms, enabling two-factor authentication wherever possible, and regularly updating privacy settings on social media accounts. This proactive approach helps create multiple layers of protection against sophisticated scammers constantly evolving their techniques.

Quick Tips Before You Go:)

✅ Be skeptical of unsolicited messages from strangers.

✅ Avoid investment opportunities promoted by new online friends.

✅ Verify platforms—check reviews and avoid unregistered trading sites.

✅ Never send money or crypto to someone you haven’t met in person.

✅ Use two-factor authentication (2FA) to secure accounts from hijacking.

✅ Report scams to authorities like the FTC, FBI, or your local cybercrime unit.

💡 Rule of Thumb: If it sounds too good to be true, it’s a scam. Stay vigilant! 🚨